OSAKA, Japan — As political reform brings investors sweeping into Burma, its financial market might soon be waking up from decades of slumber.

“The government is aiming to set up security exchanges by 2015,” a source with Japanese brokerage firm Daiwa Securities Group told The Irrawaddy.

The company, together with the Tokyo Stock Exchange, is expected to sign a memorandum of understanding with Burma’s central bank on the setting up of stock exchange soon, according to recent press reports.

“It is worth noting that our strong commitment to create exchanges has remained the same since 1996. [We have] never withdrawn from the country, even during extremely difficult times like the Asian financial crisis of 1997,” the source told The Irrawaddy on condition of anonymity.

“Daiwa established the Myanmar Securities Exchange Centre [MSEC] with the Myanmar Economic Bank in 1996,” the source said. “Daiwa [has] provided [financial] expertise through MSEC since its establishment.”

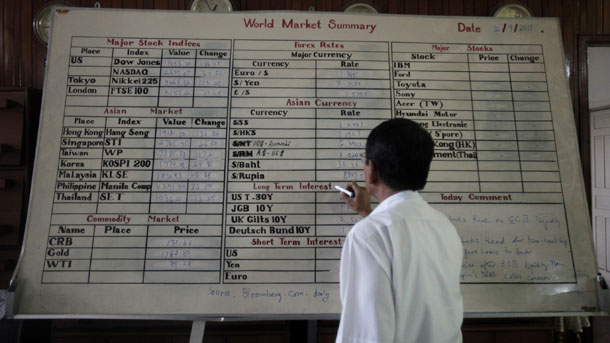

A 50-50 Japanese-Burmese joint venture, MSEC trades the shares of just two firms and sells Burmese government treasury bonds as an agent for the Central Bank of Myanmar. It has an 11-member staff, including two Japanese nationals, The Japan Times reported in February.

“Now as Myanmar [Burma] implements economic measures, we can finally get down to business,” Shigeto Kashiwazaki, the managing director of the Asian business research department at Daiwa Institute of Research, told the Japanese daily.

The Japanese thus seem to be beating the Seoul-based Korea Exchange (KRX) with their long-standing presence in the newly fueled race for the contract to set up Burma’s stock exchange.

“Korea and KRX are eager to participate in Myanmar stock exchange establishment and it would be a great honor for us,” Jungmyoung Seo, KRX’s assistant manager for global business development, told The Irrawaddy.

“KRX is trying to share its experience with the Myanmar government, but nothing specific has been proceeded yet,” Seo said.

KRX representatives had visited Burma twice for talks, Reuters reported in January.

The Seoul-based government-run corporation co-established the Laos Stock Exchange in January, three and half years after it had signed a memorandum of understanding with the Bank of Lao PDR on establishment of the stock market.

It also co-established the stock exchanges in Vietnam and Cambodia, Seo said.

Asked about the growing competition from Korea, the source affiliated with Daiwa said, “We are not concerned at all.”

“There is something of a competition between the newly-on-the-scene Koreans, and Daiwa as the original partners,” Burma specialist Sean Turnell of Macquarie University in Sydney, Australia, told The Irrawaddy on Saturday.

A 2015 start date “with few stocks initially” was “feasible” for the stock exchange, said the economist. “Such an exchange might also serve as a trading platform for Burma’s growing bond market.”

Until the Great Depression struck in 1929, Rangoon had a small-scale stock exchange that largely followed the quotations in Bombay (Mumbai) and Calcutta (Kolkata). After achieving independence from British colonial rule, Burma allowed trade in shares until the introduction of the central planning system in 1962.

The military junta started issuing government treasury bonds in 1993. Myanmar Economic Bank and MSEC, its joint venture with Daiwa, have underwritten government treasury bonds since 2010, according to the Central Bank of Myanmar.

A central bank study group drafted a “road map” for the development of a capital market in Burma in 2006. Since then, reports of these preparations have surfaced with increasing regularity.

In January, the Stock Exchange of Thailand said in a press release that the deputy governors of Burma’s central bank and the Myanmar Economic Bank were briefed in Bangkok on “capital market supervision and development”.