YANGON—Despite the surge in COVID-19 in Myanmar, Chinese companies including state-owned energy giants are seeking opportunities to invest in the Dawei Special Economic Zone (SEZ), a US$8-billion (10.4-trillion-kyat) strategic project in southern Myanmar’s Tanintharyi Region that is set to be Southeast Asia’s largest industrial complex.

The Dawei SEZ management committee has invited international companies to invest in the full phase of the long-delayed Dawei project. Dr. Myint San, vice chair (2) of the committee, told The Irrawaddy, “Eight out of 10 proposals were from Chinese companies.”

“Chinese companies are quite interested in the Dawei SEZ. Some are already planning feasibility studies for their proposed projects,” Dr. Myint San said.

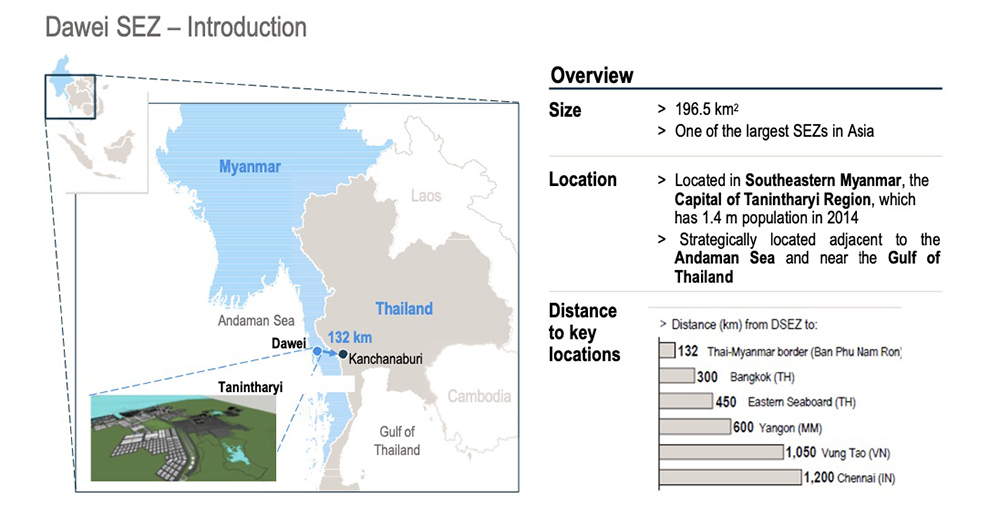

Located in Tanintharyi Region, the SEZ is adjacent to the Andaman Sea and near the Gulf of Thailand. It lies in a strategic location connecting the Indian and Pacific Oceans and linking Southeast Asia with South Asia, the Middle East, Europe and Africa. The SEZ also plays a vital role in the Mekong Southern Economic Corridor, which aims to connect central Vietnam, Cambodia and Thailand to the Dawei SEZ in southeastern Myanmar.

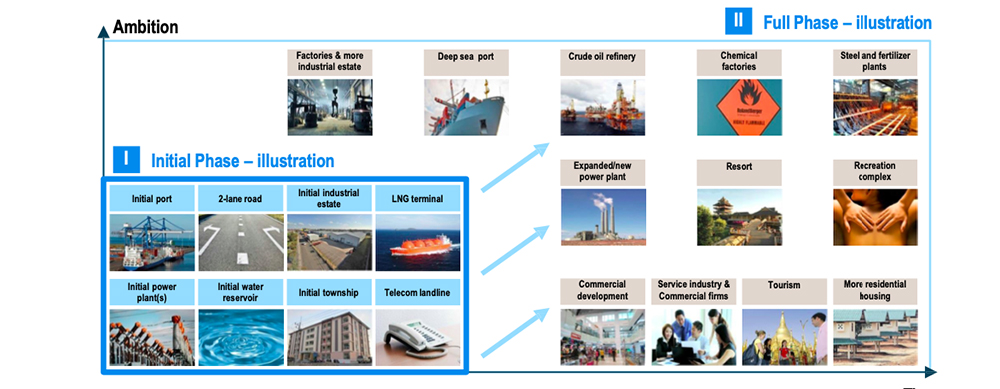

Planning to transform Dawei into Southeast Asia’s largest industrial and trade complex, the 196-sq.-km project includes a deep seaport and is expected be a potential boon for firms currently relying on the transport of goods via the crowded Malacca Strait. The planned project also includes high-tech industrial zones, information technology zones, export-processing zones, port area zones, transportation zones, service business zones and other infrastructure projects.

“China has ambitious goals when it comes to access to the oceans. The Dawei SEZ would serve as a potential hub for China. Chinese companies seem to think Dawei could become another door to access the [Indian Ocean] for China,” Dr. Myint San said.

Among Chinese companies, those interested in the construction of the large oil refinery project have already agreed to carry out a feasibility study (FS), according to the management committee. These include proposals from Yunnan Indo-Pacific Group (Indo-Pacific), Zhong’an Co. Ltd, CNPC East China Design Institute (CEI) and locally owned Myanmar Chemical & Machinery Co., Ltd.

Moreover, the management committee has also discussed proposals for refinery projects in the SEZ with Hong Kong New Energy Investment Holdings Limited, China HuanQiu Contracting & Engineering Co., Ltd (HQCEC), China Petroleum Pipeline Engineering Co., Ltd (CPP) and China Energy Engineering Corporation (CEEC).

CPP is a subsidiary of the Chinese state-owned China National Petroleum Corporation (CNPC), the main shareholder in a controversial twin oil and natural gas pipeline project running in parallel from the port of Kyaukphyu in Rakhine State on the Bay of Bengal through Magwe and Mandalay regions and northern Shan State before entering China. HQEC is also affiliated with China National Petroleum Corporation (CNPC)—engaging in consultation, engineering, construction management, procurement and equipment manufacturing.

CEEC, also known as Energy China, is also a state-owned energy conglomerate. It has already invested in energy projects and offered technical support to major energy projects in Myanmar. It completed construction of a 118 MW gas-fired power plant in Mon State. In 2019, a consortium led by CEEC was awarded a project to implement a 120 MW power plant in Alone Township in Yangon.

“Some Chinese companies are joint ventures with local companies. But when we check the shareholder agreements, Chinese own a majority [of the shares],” Dr. Myint San said.

“They are so eager to seek the potential investment opportunities there. When we checked them, they prepared documents well for the proposal including showing their financial capabilities,” he added.

The project was originally backed by the Thai government. In 2008, Italian-Thai Development PCL (ITD) was granted a 75-year concession to develop and attract investment to Dawei SEZ. It was scheduled to complete it in 2015, but financial constraints saw ITD withdraw from the agreement in 2013.

In 2015, Myanmar and Thailand renegotiated the original agreement to allow ITD and related companies to develop up to 27 sq. km of the initial phase of infrastructure projects. The concession for the initial phase projects (including an industrial estate and supporting infrastructure such as power plants, a small port, an LNG terminal and other related projects) was officially granted to a consortium led by ITD in August 2015 and March 2016.

Japan has an interest in the Dawei SEZ, which lies on its envisioned Southern Economic Corridor, part of Tokyo’s development strategy for the Greater Mekong Subregion. In 2015 Myanmar, Thailand and Japan signed a Memorandum of Incorporation (MOI), which brought Japan into the Dawei SEZ Development Company Limited (SPV) as a third shareholder.

The shareholders are Thailand’s Neighboring Countries Economic Development Cooperation Agency (NEDA), Myanmar’s Foreign Economic Relations Department (FERD) and the Japan Bank for International Cooperation (JBIC). The main function of the company is to advise the management committee on the comprehensive development of the SEZ and to invite international investors. However, the company has not pursued international investors.

Last year, the Myanmar government and ITD completed final negotiations for the construction of the initial phase. However, the company is reluctant to begin the project. Under the initial agreement, Myanmar and Thailand have agreed to implement the initial phase first.

However, during a bilateral ministerial meeting in October last year, the two governments agreed to begin the “initial” and “full” phases of the project at the same time. Moreover, they decided to the invite third-party investment for the full phase implementation of the SEZ including deep seaport and electricity supply.

The Japan International Cooperation Agency (JICA) also conducted a fact-finding study based on NEDA’s existing master plan to ensure it is in conformity with changing political, economic and social conditions. According to the committee, NEDA’s original master plan was more focused on creating a heavy industrial complex, while JICA’s study is more focused on a light industrial complex. However, Myanmar has yet to decide the development model.

“Since JICA submitted a development model for the Dawei SEZ, we were hopeful that Japanese investors would definitely come to our project. Despite several rounds of meeting with Japanese stakeholders, they no show sign of interest in the project,” Dr. Myint San said.

“We also asked them to have government-to-government [G-to-G] agreements to attract Japanese investors. But it did not work out,” he said.

“In the eyes of the Japanese investors, the Dawei project has to wait for a long time for commercial viability. It is also weak in infrastructure. These would be major reasons that they are not willing to invest in it,” he added.

The infrastructural weaknesses, particularly with the roads and electricity supply, are the major challenges for international investors. Part of the Dawei SEZ project involves upgrading a two-lane highway connecting Dawei with Thailand. The Union Parliament approved in March last year a 4.5-billion-baht (186.26-billion-kyat) low-interest loan from NEDA for the project. The route will connect the border crossing point at Htee Kee to the SEZ via Myittar to assist in the transportation of raw materials needed to complete the Dawei SEZ construction projects.

The Energy Ministry said in 2018 that only 16 percent of Tanintharyi residents had access to the national grid. Currently, the government is planning to build transmission lines for Dawei to connect with the national gird.

On the other hand, China has asked the Myanmar government to share the study report for the project in order to look for potential investment opportunities in the Dawei SEZ, according to a source familiar with the matter. However, the government decided not to share it with China as it has agreed the third party is not allowed to obtain it.

The SEZ management committee is considering wooing Indian investors once COVID-19 conditions improve.

“The electricity supply and a two-lane highway project are underway. We will need to construct the deep seaport. We are currently looking for investors to invest in the deep seaport,” Dr. Myint San said.

“It is a mega project. So, one country cannot afford to develop the whole project. It is a strategic project and the location is important geographically. If there is no one, we have to ask other countries like China to invest in it under the G-to-G agreement,” he said.

“We are growing impatient because locals have already waited for many years. We have already spent years on it; we can’t wait any longer for the development,” he added.

Kazuyuki Takimi, counselor and head of the Development Assistance Section at the Japanese Embassy in Myanmar, told The Irrawaddy that Japan is still eyeing investing in the Dawei SEZ with the aim of assisting development in Myanmar.

“We are interested to invest in [the] Dawei SEZ. However, it needs to take time when it comes to discussing the details for [the G-to-G] process. Moreover, we still need to consider the details for the [possible] investment,” Takimi said.

“We … very much [appreciate] what Myanmar can offer. We will continue to discuss with the Myanmar government what we can do for … investment in the Dawei SEZ,” he said.

You may also like these stories:

Myanmar, S. Korea Pledge to Step Up Cooperation on Trade, Investment, Energy

Myanmar Traders Brace for Another Hit as China Closes Key Customs Gate Due to COVID-19

Despite Current Economic Fallout in Myanmar, ADB Forecasts a Bounce